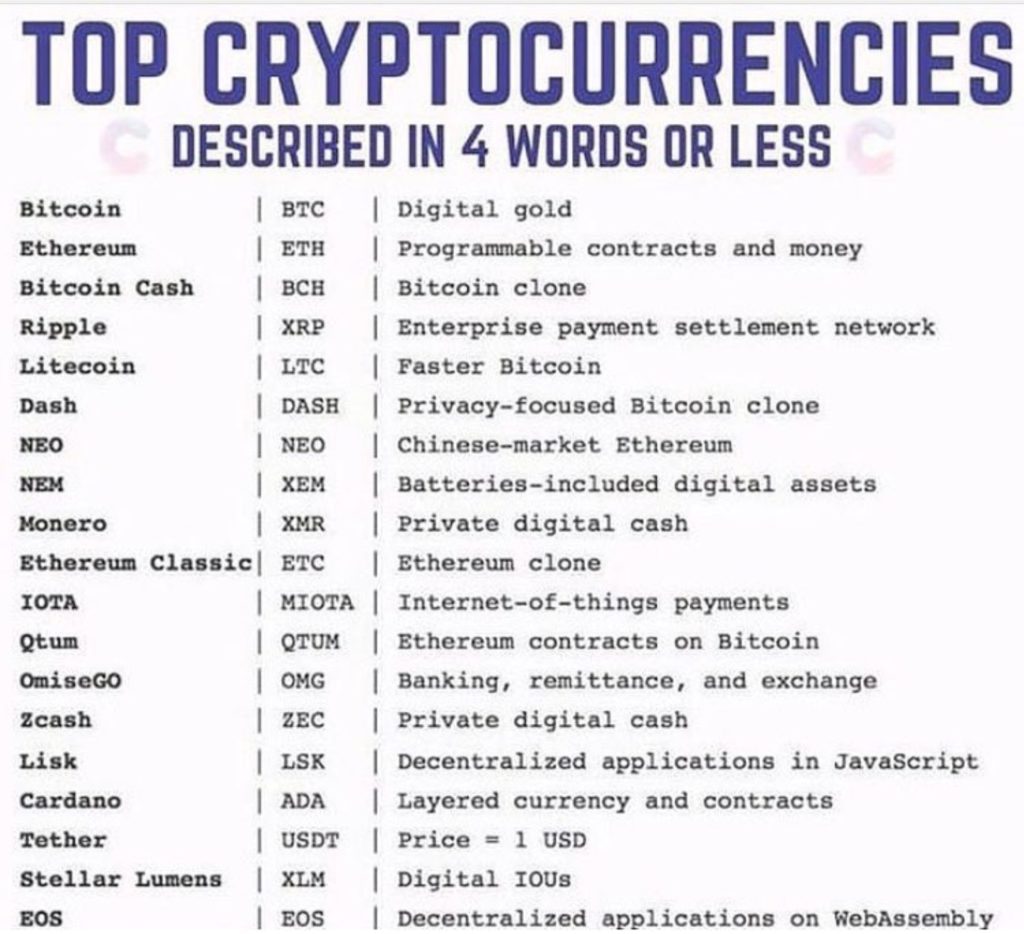

Bitcoin trading has become increasingly popular in the recent past. There are people who have made tons of money through trading various cryptocurrencies. Unfortunately, there are others who have not been able to get the returns they were expecting. The differences between the two groups of people are the strategies they applied, patience and greed. This means that the people who make money apply certain strategies which are helpful. You too can be successful in trading if you apply the right strategies. Below are 7 ways to succeed in Bitcoin trading. Also, some primary guidelines on how to become more confident as a trader in the crypto space. Here are some of the top cryptocurrencies in described in 4 words or less.

Invest What You Can Afford To Lose

While trading in Bitcoin it is always advisable to trade on only what you can afford to lose. All the people who trade hope to make profits from the trading. This can tempt you to trade even with the money that was meant for other important things such as paying the school fees for your kids. In case you lose much money you will be very stressed and you will not be able to trade properly in the future. When you trade with money you cannot afford to lose you also lose focus because of the fear of that something bad might happen. We call this FUD. (Fear, Uncertainty & Doubt) This makes it important to ensure that the money you are using to trade cannot affect other aspects of your life if it is lost.

Have Reliable Sources of Information

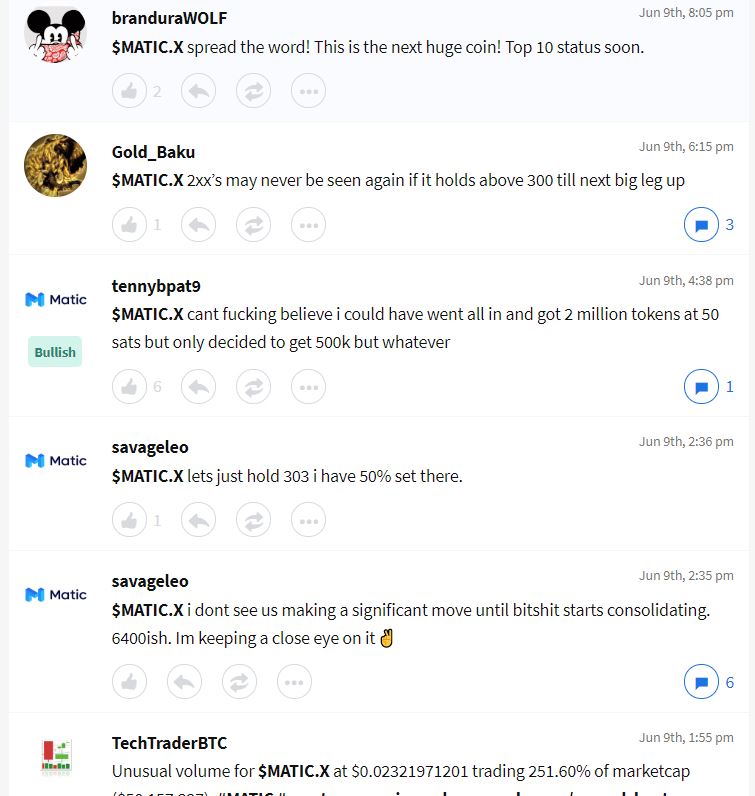

A lot of people trade Bitcoin based on the information they get from different sources. Some of the available sources might be misleading and as a result, it is important to be careful and try to always do your own research. There even sources which mislead traders deliberately so that they can benefit in different ways. But if you have reliable sources of information, you will be able to always make informed decisions. If you lose money multiple times after relying on a certain source, you should look for a better source of information. Remember that EVERYONE has predictions! I have made money and lost money listening to other people. Some investors give advice and predictions without doing a due diligence but then get lucky. The screen shot below in a Matic coin forum where people are mostly bullish. What you decide to do with the information at hand is entirely up to you.

“Sats” = Satoshi’s.

Satoshi’s = Smallest unit or % of Bitcoin.

One hundred millionth (0.00000001) of a single bitcoin is a sotoshi.

Start Small

While getting into Bitcoin trading you should start with a small amount. This is because it takes time before you can fully understand how to trade. There are certain tactics which can only be learned through experience. This means that beginners might not know about these particular tricks. As a result, you should start trading with a small amount before you can learn and know how the system works. After some time you can increase the amount you are trading with provided you are trading with money you can afford to lose.

Be Realistic

Some people get into Bitcoin trading expecting to be rich within a short time. Most of such people end up being disappointed after not making the profits they were expecting. They also make irrational decisions because they are always in a hurry to get as much money as they can within a short time. But if you are realistic you will be able to make informed decisions. You won’t be discouraged when profits don’t reach the levels you were expecting. It is important to understand that trading in Bitcoin is just like making any other investment where risk is involved. Depending on how much you are investing, set a daily price you will be happy making whether that is $50, $100, $500, etc. And always take your profits!

If you can trade a few hours each day and pull in an extra $200/day, that is roughly an extra $60,000-$70,000 a year. And $200 a day is very achievable with you the right knowledge and tools. Just protect your downside and consistently take your profits and you’ll be fine.

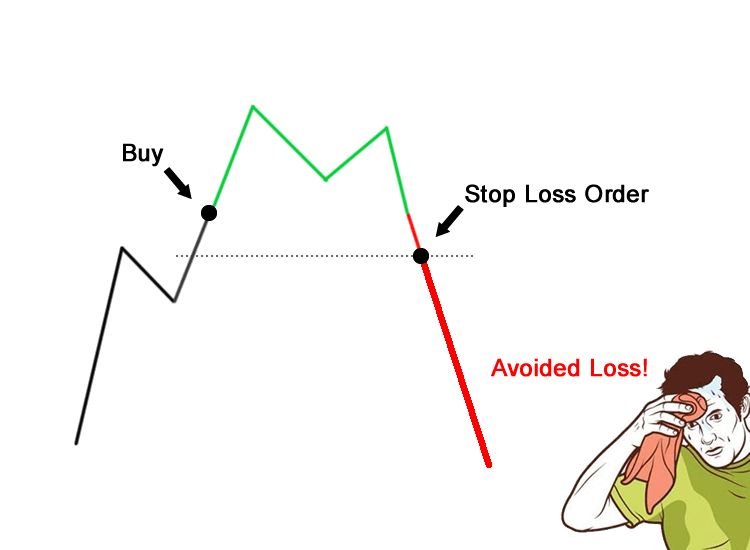

Learn About Stop Loss

The stop-loss option is where you set the levels of losses where the trade gets closed. This particular option is helpful in that it prevents you from losing everything. It protects your downside. There are a lot of traders who make the mistake of hoping that things will get better despite suffering huge losses. Such traders wait until it is too late where they lose substantial amounts of money. But if you use the stop-loss option, a sell order will automatically trigger if the price drops to your targeted sell limit. You can sleep soundly knowing that if the price tanks, you won’t be on that ship.

Manage Risks Effectively

When trading in Bitcoin, it is also very helpful to know how to manage risks. You should know the things to do and the things to avoid while trading. A good example is that in a non-liquid market you should never invest more than a small portfolio percentage. It is also not wise to aim for the peak of the movement. These tricks will significantly help you manage your risks and as a result, reduce chances of losing your money. Therefore, through applying the outlined tips and strategies you can effectively be successful in day or swing trading.

View this post on InstagramA post shared by Motivation| Crypto| Lifestyle (@the_motivation_niche) on

Avoid Jumping Into Deals

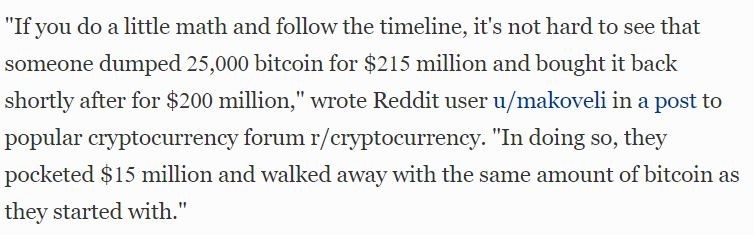

You will come across deals which seem to be very good at first glance. You might be tempted to jump into such deals so you can make a decent return. It’s advisable to be cautious before doing so. The main reason behind this is that the whales (wealthy traders) are always looking to take advantage of the mistakes made by the small traders. The whales have the ability to put huge blocks of Bitcoin on the order book. As a result, they can manipulate the market in their favor. Here’s a recent story of just that.

Consequently, it is always advisable to check out different cryptos and do your own research before deciding whether to invest or not.

Awesome article about Crypto Currency with the focus on Bitcoin. It is honestly crazy, at how Bitcoin (BTC) has been as high as $20,000 per coin. It is a very volatile instrument. I own both BTC and Ripple (XRP). In fact, I purchased some XRP yesterday on the dip at $0.3905.

Sometimes I buy on the dip and sell on the rise… Looking to unload around $0.4500.

Do you actively trade?

Hey Brian! Good for you. I think it’s smart to hold some of those top coins. The volatility is what attracted me to the space in the first place. I have made out very well on some coins that mooned as soon as they were listed on a top exchange. I do actively trade. I try to find good positions to enter a trade a few times a week. I set my stop-losses, monitor my upside then sell when I’m happy enough to call it a day.

Cheers and best of luck.

Casey

Hey Casey,

Thank you for sharing this awesome article on how to success in Bitcoin Trading.

Frankly speaking, I always has the interest to invest in Bitcoin and has opened a demo account with a broker firm previously but never made a gain due to lack of knowledge.

Now l can confidently trading in Bitcoin following your 7 steps strategies. By the way, can you recommend a reliable broker firm for me to trade Bitcoin?

Cheers:

Hi Shui,

Fidelity investments has launched Fidelity Digital Assets. Depending if you want to hold or trade, you can purchase a few of the more prominent cryptocurrencies on Gemini then move them to an exchange like Binance to trade.

Best of luck!