Just like the past few years, this year (2019), we can observe that the price of cryptocurrencies tend to move up and down by a wide margin, some by even a thousand percent in daily value. These changes is what is broadly known as volatility.

Now, it’s very difficult to foresee such gains. Keep in mind, the crypto market is the wild west. No Mon-Fri 9-4, big bank influenced Wall Street here. This is 24/7 world wide. The traditional rules don’t apply here which make’s it easy to lose and exciting to make money.

However, what if, the maximum projection has been known by the creators (of specific cryptocurrencies), but all these changes were a part of the bigger plan of these cryptographic currencies as a major characteristic to allow you (the investor) to make awesome profits?

The 1 Percenters

First off, the cryptocurrencies made it to the mainstream just recently, for that reason all the news regarding them and reports are “hot”. In fact, if you own just .28 Bitcoin, that makes you a 1 percenter of the future Bitcoin world. If you do own 1% of BTC, then you can be certain no more than 1% of the world’s population can ever own more Bitcoin than you because of the fixed supply. After each statement of government officials about potentially regulating or prohibiting the cryptocurrency market, we always observe huge swings in the prices.

Secondly, the nature of cryptocurrencies is more like a “store of value” (like gold had actually remained in the past) – numerous financiers consider these as backup investment choice to stocks, physical possessions like gold and fiat (standard) currencies. The speed of transfer also has an influence on the volatility of the cryptocurrency. With the fastest ones, the transfer takes even just a couple of seconds (up to a minute). This is what makes them exceptional assets for short-term trading if currently there is no better approach to other kinds of assets.

What everyone should bear in mind, however, is that speed goes as well for the lifespan trends on cryptocurrencies. While on regular markets, these trends might last months and even years. With cryptocurrencies, it happens within days or even hours.

Hype & Rumors Influence

This leads us to the next point – although we are speaking of a market worth billions of US dollars, that value is still a really small amount when compared with everyday trading volume which deals with the conventional currency market or stocks. For that reason, a single financier making a transaction of a 100 million US dollars on a stock exchange will not cause a substantial change in the rate, but on a scale of the cryptocurrency market, this is a noticeable and significant transaction.

As cryptocurrencies are digital assets, they are subject to technical and software updates of cryptocurrency-related features or expanding blockchain cooperation, which makes it more attractive to the potential investors (like activation of SegWit generally triggered value of Bitcoin to be doubled).

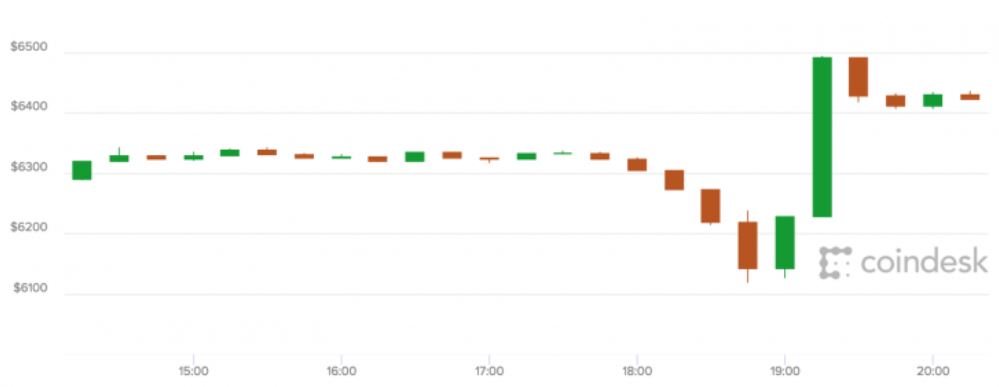

These aspects combined are the reasons why we are observing such big price changes in the cost of cryptocurrencies within every couple of hours, days, weeks, etc. Below is an example of when Bitcoin shot up nearly $300 is 30 minutes.

A lot of traditional day traders have moved over to cryptocurrencies because they find more waves and chances of consistently securing profits every day. Hell, the first trade got into, I made $400 while I was sleeping. Since then, I was hooked. I am now logged into Binance (the leading & most trusted cryptocurrency exchange) for at least a few hours a day waiting patiently for the right move.

I will conclude this piece by addressing the question from the first paragraph. One of the classic rules of trading is to buy low, sell high – for that reason having short, however, strong trends every day provides much more of a chance to make a decent revenue if utilized properly.