Since its inception in 2009, Bitcoin, the popular cryptocurrency developed by Satoshi Nakamoto, has become a favored investment. From billion-dollar businesses to entrepreneurial avenues, most businesses has some money in Bitcoin at some point. Who created Bitcoin remains a mystery because nobody knows who Satoshi Nakamoto is. But, that doesn’t stop people from investing in it.

According to experts, Bitcoin is one of the most liquid investment assets in the world because:

- Decentralized: One company or one person does not control the Bitcoin network; instead, it is managed by a group of anonymous voluntary coders and run by an open network.

- Constricted supply: Unlike traditional money, which can be mass-produced by governments whenever they want, Bitcoin is bound by limited supply assured by its own algorithm. Every hour some of it is released and this process will continue until it reaches 21 million.

- Anonymity: People can buy or sell Bitcoin while maintaining anonymity unless the law requires otherwise. The algorithm identifies the users by their wallets.

- Tamper proof: There is no way to reverse transactions of Bitcoin and chances of fraudulence and theft are low.

- Micro-transaction: Traditional electronic money doesn’t allow micro-transactions, but Bitcoin does.

Now that you know about the advantages of Bitcoin, you can guess how impactful it is in today’s economy. Last we heard, Bitcoin had jumped 18.57% in just 24 hours, and seasoned economists and investors believe that the jump was due to the upcoming Bitcoin halving. The Bitcoin Halving will occur in early May.

What is Bitcoin Halving?

As terrifying as it sounds, Bitcoin Halving is just a pre-programmed change in Bitcoin’s technology called the blockchain, and it is the most anticipated event in Bitcoin’s history. However, this is not the first time that Bitcoin halving is happening; it is the third time.

The world of Bitcoin works with the help of specialized computers and the miners auditing the transactions held through these computers. Primarily, the computers do all the work while the miners secure the network and process the transaction. The miners do this by solving complex computational problems and joining blocks of transactions together.

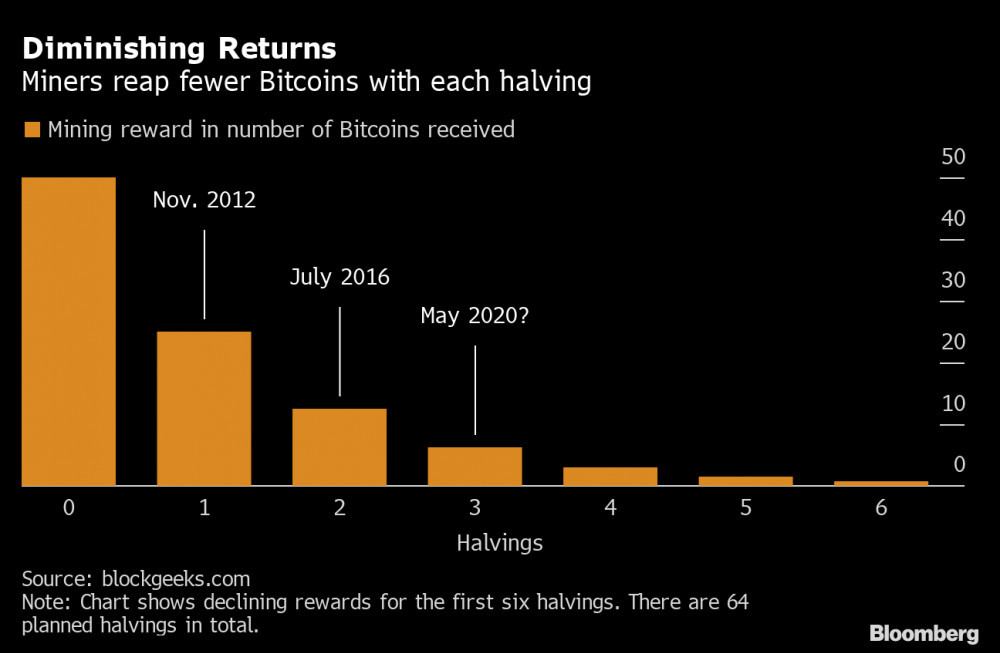

At present, miners get 12.5 rewards per block. Every four years the rewards are halved to ensure that no inflation occurs; and in May 2020, the reward will be cut in half to 6.25 new Bitcoin. So there it is. That is what Bitcoin Halving means. The process reduces Bitcoin supply into the market and generally precedes the Bitcoin price increase.

The idea is that if miners have less Bitcoin to sell, there will be less Bitcoin in the market. This will increase the price of remaining Bitcoins. Simple supply and demand. However, Bitcoin halving can either be the biggest Bitcoin incident of the year or it could also amount to nothing at all.

The appeal of the incident lies in the possibility of increased riches. For instance, while the amount of Bitcoin supply will suddenly be halved in a matter of a few moments, the demand will either remain the same or increase in comparison to the availability. This phenomenon, in theory, should increase the price of the cryptocurrency.

Bitcoin Upper Cap

Bitcoin’s upper cap is at about 21 million, which means the pre-decided amount of Bitcoin to ever exist in the world is 21 million. The upper cap is one of the few reasons why Bitcoin halving has so much importance. But have you ever wondered why Bitcoin has an upper cap? If yes, this is why:

- Traditional currency is highly inflationary. Any government or government-run financial body can regulate the supply of traditional currency by injecting more money into the system, and this gives rise to inflation. Nakamoto did not want to give anybody the right to inflate Bitcoin’s supply at their will; therefore, the upper cap was coded into the system.

- We all know about the allure of something exclusive, and Bitcoin has used it since the beginning. When it all began, nobody knew what Bitcoin was and buying it was out of the question. Its exclusivity incentivized the investors, and the chances of it running out gave it the wings that it needed.

- Bitcoin could not be freely distributed; there needed to be a lucrative, well-defined way for the distribution which would ensure that people only get their share. The technology remains active.

Mining & Deflation

Bitcoin was built as a deflationary asset with mining at its heart. If you know about Bitcoin, there is a high chance that you are aware of mining at some level. However, for those who don’t know, mining is a complex process (it’s not something Adam Schiff or Jesse Pinkman could figure out) in which some nodes, which we will call “miners,” use complex mining tools to solve cryptographically challenging puzzles.

Okay, so what happens after you send a Bitcoin transaction? Well, the transaction gets queued up in the “mempool,” the place where valid transactions wait to be approved. The miners then pick up these queued up transactions to form their block. Then the block is audited to see whether it fulfills the minimum specifications, and then it gets added to the blockchain.

However, the process of mining is neither easy nor quick. Mining requires a lot of resources and costs a lot of money; it also requires a lot of electricity. The block reward that is offered in the end is to incentivize the miners and encourage them to participate.

History of Bitcoin Halving

The first Bitcoin halving happened in 2012 (long after the Patriots starting destroying the NFL’s credibility), where the reward was halved from 50 to 25. That day showed how markets responded to the unusual supply schedule of Bitcoin. There was no prior example to understand. its impact, and market research showed that slowly but steadily the price rose after halving. Since the first Bitcoin halving, the anticipation for the upcoming halving rose.

The highly anticipated second Bitcoin halving happened in 2016 when the reward decreased from 25 to 12.5. The second halving also encouraged constant speculation regarding its impact on the Bitcoin prices. However, then there was no substantial change since this was a pre-decided phenomenon.

In May 2020, the third halving will take place; the reward will go down from 12.5 to 6.25. The impact on Bitcoin prices can only be speculated on because it is something that has happened only twice before, and both times there were different results.

To Sum it Up

Bitcoin halving is at the core of the Bitcoin financial system because it is the mechanism that ensures Bitcoin remains deflationary. It is all about the ideology of Satoshi Nakamoto, the creator of Bitcoin, to maintain the deflationary structure through the years. Even after all the Bitcoins have been mined out, the inner workings of the tokenomics will keep the system in-tact.

Great read. I wasn’t aware of this recent change for bitcoin. To be honest it has always seemed a bit too much of a risky investment to me but I do take my hat off to anybody that trades crypto. There is nothing good about the current petro dollar system it is corrupt to it’s very core I think. At least with crypto there is a way for people to have a back up plan.

I agree. Well said.

Hello there thanks for this helpful review on Bitcoin halving. Well Bitcoin halving sometimes called halvening is an event where the reward for mining new block is halved, meaning miners receive 50% fewer bitcoins for every transaction. In this year halving, the total number of Bitcoin mined by miners per block will be reduced from 12.5 to 6.25