You have had to be living under a rock if you haven’t heard about cryptocurrency. In the last ten years, cryptocurrency has become one of the largest investment opportunities and has expanded worldwide. There are over 7000 different types of cryptocurrencies with Bitcoin being at the top since it’s inception in 2009. If you have ever considered getting involved in cryptocurrency but still a little hesitant because of its complexity, here are some essential nuggets you should know to help you get your feet wet.

Not A Road to Instant Wealth

Firstly, and it must be said, while investing and trading in crypto can be immensely profitable, there are no guarantees. There is a common misconception that you can get rich fast through cryptocurrency. If you do, you got extremely lucky. It’s important to know that this is not an easy short-cut to wealth, it requires work, patience and wisdom, and whatever amount of money you’re putting in, you’ll have to be willing (and able) to lose, should things take a turn downhill. A lot of times, the intelligent move is to be greedy when others are fearful.

Secondly, while Bitcoin is the dominant crypto in market cap, there is a wide range of altcoins such as Ethereum, Cardano, Litecoin, Matic and Celsius. Each transaction is recorded on an associated blockchain.

Safety Is A Priority

While blockchain technology is incredibly safe, you still need to think carefully about how to protect yourself from hackers and scammers, and make informed decisions about where you will trade and how you will store your funds (keys).

Here are some basic tips on safety:

- – Get a fresh, new, secure email account to prevent your details from ending up in the wrong hands. Secure email accounts include Protonmail and Gmail.

- – Subscribe to a VPN service in order to prevent others from tracking your online activity, especially while trading. Good VPN services include ExpressVPN and NordVPN.

- – Install an antivirus software such as Avast or Kaspersky, in order to protect your devices against Trojan horses or other threats.

- – Always enable two-factor authentication on your devices.

Wallets

In order to store and trade crypto you’ll need a wallet. While funds themselves never actually leave the blockchain, wallets hold the keys associated with your funds, and whoever holds the keys controls the funds.

The easiest way to get a wallet for your funds is by registering with an exchange, such as Coinbase, Binance, Kucoin or over-the-counter platforms (OTCs). It is important to know that exchange platforms only list a limited number of currencies. Wallets are currency specific, supporting only a number of tokens. There are many different types of wallets:

Hot wallets: such as desktop or lite wallets (usually created by the token developers), mobile wallets (app-based), and online wallets (offered by exchanges to send and receive tokens), are needed to trade. However, as they are connected to the Internet and therefore susceptible to hacking, it is recommended that you store a large portion of your funds in a cold wallet.

Cold wallets: are not connected to the Internet. They can be paper wallets (simply, a print out of your keys along with a QR code you can scan) or hardware wallets (a device that is similar to a USB-stick or external hard drive). Currently, hardware wallets such as Trezor or Ledger are regarded as the safest way to store your funds.

Exchanges

In order to get started with crypto, you’ll need to obtain crypto. Bitcoin, due to its overwhelming popularity and fame, is by far the easiest one to obtain. However, altcoins such as Ethereum and Cardano, can also be bought with fiat currency.

When it comes to choosing where to trade there are a number of things to consider.

Location: Rules and regulations are not the same across the board. They’re not even the same in the United States. I can sign up and trade some cryptocurrencies in California while New York cannot. Do some DD on the regulations of your home state or Country.

Peer-to-peer: While it is possible to trade directly with people met through ads or organized meetups, this method of obtaining and trading crypto is not recommended. It is easy to become a victim of fraud and once you’ve transferred funds to the other there is no way to get your funds back if you’re trading partner doesn’t stick to their end of the bargain.

Over-the-counter: There are plenty of OTCs that mediate between buyers and sellers, usually offering a platform for ads to be placed and some type of escrow service. Many OTCs will enable buyers to obtain crypto using PayPal or a credit card. They may charge low fees, but it is important to be mindful of the fees charged by the bank as well. Although OTCs are sometimes preferred by those who wish to trade in large multi-million dollar amounts, not all OTCs are safe. They are not free from scams and both buyers and sellers will need to trust the broker as well.

Exchanges: Some exchanges like Coinbase and Binance.US enable buyers to obtain crypto using a credit card. With Bitspark, it’s even possible to get crypto with cash or a bank transfer (and vice versa). Many exchanges assume traders already have cryptocurrencies and in order to trade on these exchanges the trader needs to deposit their funds into their exchange account (wallet).

Exchanges are good to begin with in order to easily trade in and out of different currencies. It will be important to check which currencies are supported. Whereas Binance.US is well-known for its wide array of different currencies, including tokens from recent ICOs, an exchange like Kucoin boasts a variety of stablecoins, which are cryptocurrencies pegged to fiat currencies such as the US dollar, Renminbi and the Hong Kong Dollar.

How Trading Is Conducted

There are three main ways to conduct a trade:

Limit trade

This allows you to set a price you want to buy or sell a token at and specify the amount of tokens you want. When the price of the token hits your price target, the buy or sell order is automatically filled. Limit trades are the most popular because fees are not associated with them.

Market trade

Some exchanges like Binance and Bittrex allow you to buy or sell at the market rate. This is the quickest way to buy or sell a token immediately. A fee might apply.

Stop limit

This way of trading basically enables you to automatically trigger and order at a set price (or a better one), up until a set limit. This also works the other way around if you place a stop limit sell order.

Portfolio

As you dive deeper into the crypto space, you’re likely to end up trading a variety of coins at different exchanges. There are apps out there which can help you log your trades and assist you in remembering which tokens you’re invested into, how much you’ve bought, what price you’ve bought in at, and so on. Apps that you could consider are Blockfolio and Delta.

Stay Up to Date on Trends and New Information

Trading in crypto is an ongoing process. It is still a young field where lots of developments are happening simultaneously, whether from a technological, a regulatory or a social perspective. Last I heard, under .0027% of the population own 1 Bitcoin. It’s good to keep up to date and track news regularly for important events, new and insights. Educate yourself on market cycles.

Lastly, it’s good meet like-minded individuals through MeetUp, Stocktwits, at business events or conferences. I’m in a specific altcoin group and we are planning a meetup in Las Vegas in 2022. There’s always something to look forward to in the wild, wild land of crypto!

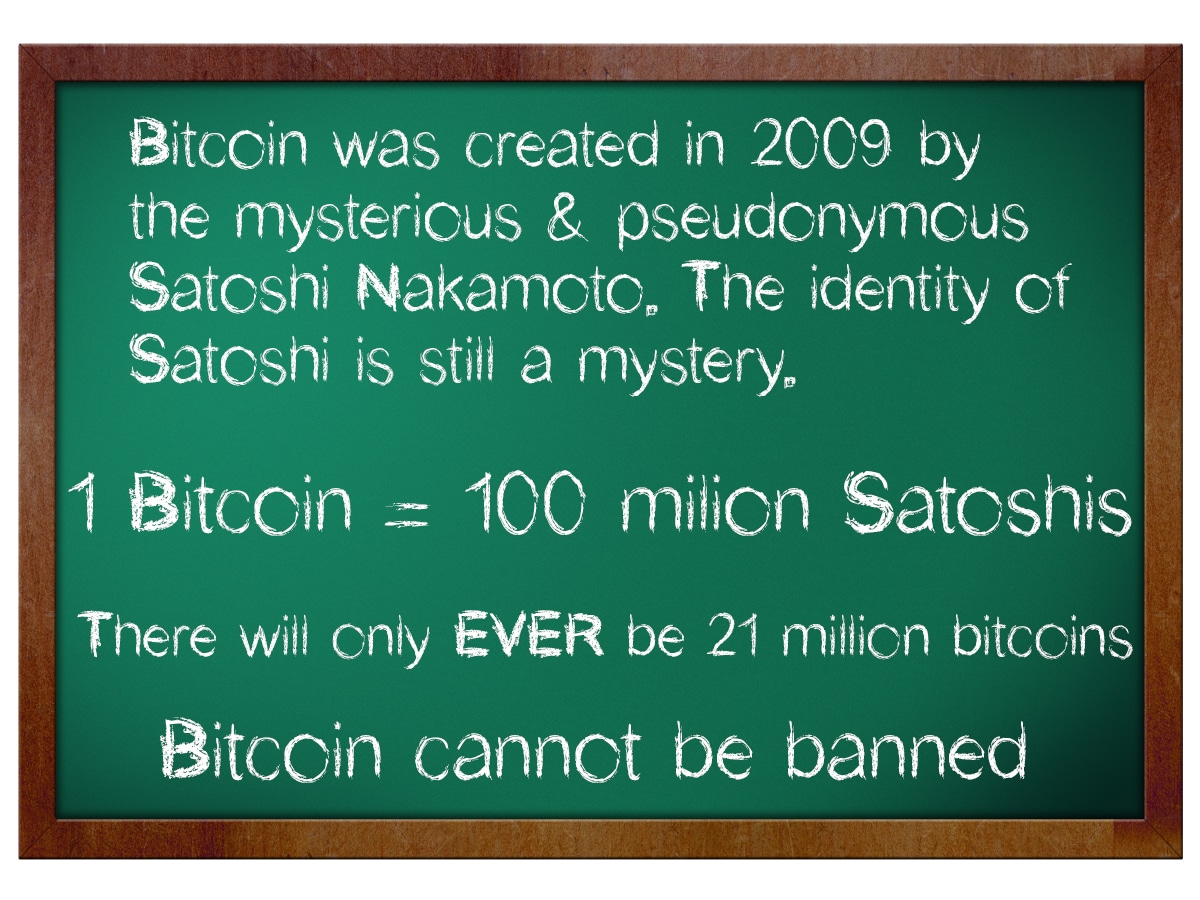

Happy trading and good luck! I’ll leave you with this fun fact…

Very informative article.

I never new much about Bitcoin, but I will tell you I wish I had some Monopoly money from 1935 haha. On a serious note, I want to learn more about trading, bitcoin and crypto currency, and all that. It’s all a bit intimidating to me. Maybe one day I’ll have the time to look into it a little more. I hear it can be very lucrative.

Hi Tiffany, yeah there are a lot of ways to supplement your income with crypto now especially in a bull market. The Celsius Network and entire defi space is another good route if you want to earn more interest on your money than what your bank is capable of paying you. Let me know if you would like more information on that.

This is a very informative post on getting started in cryptocurrency and bitcoin and I found the tips on safety particularly helpful. I have not come across the term “fiat” currency before, so what is it?

Trading in cryptocurrencies can be very volatile, so I have bought an ETF in cryptocurrency. What are your thoughts on a crypto ETF and do you think it is safer than trading in actual bitcoin?

Thank you. Fiat currency is the governments issued currency. So in the USA, our fiat is USD.

I expect the SEC to authorize a BTC ETF this year. I think buying BTC or Cardano right now and holding is the safest play. Even some of the most skilled traders lose money. I have been holding since 2017 and it’s sort of a “set it & forget it” and it’s also incentivized to hold because you can earn interest on it while the investment goes up.