Since the virtual coins went mainstream about three years ago, there is now a wide range of entrepreneurs that are putting money in. Here are some common cryptocurrency entrepreneurs that you should be much aware of;

The Newbie

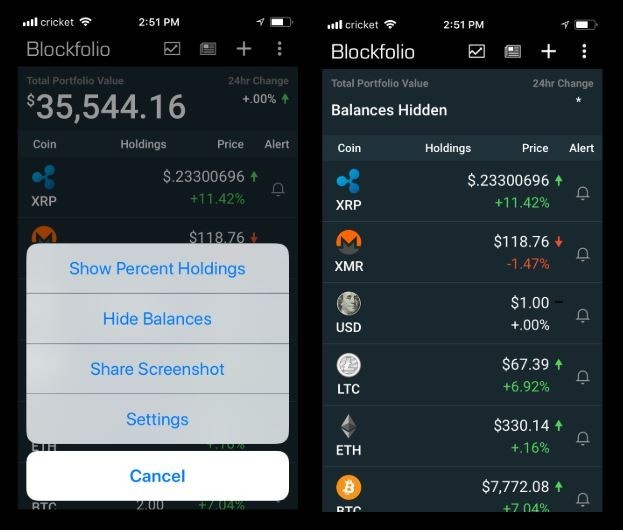

These are the new entrepreneurs that have just discovered the cryptos, but already have all the best trading applications installed on their phones or tablets. They check the price of the cryptos on an hourly basis to see how much they have made in profits.

Newbies tend to go with the trends. They panic to easily sell when prices go down by 10 to 20% in a given day. Whereas this type of cryptocurrency entrepreneurs is great for the entire crypto market since they mean adoption on the rise, they can also add to the volatility of the market. This is because they tend to purchase when everyone is purchasing and sell when everyone is selling. Just as mentioned earlier, these people move by the trend.

The Overenthusiastic Millennial

Just as it is the case with the newbies, this type of crypto entrepreneur has just got into the market and has already established a promising yet tiny online asset portfolio of the entire market’s trending new coins.

This is the kind of crypto investor who follows all the crypto celebrities on social media and will not hesitate to talk to their peers concerning the next coin to purchase next. They do all these in the hope of becoming a millionaire someday soon.

The Institutional Cryptocurrency Entrepreneur

On the other hand, the institutional crypto entrepreneur is an entirely different type of investor. They come in two main forms; the cryptocurrency funds that are run by early BTC adopters and the funds have just recently ventured into this brand new asset class in the hope to get huge returns.

Pantera Capital and other longstanding cryptocurrency funds have been investing actively in the online digital market for so many years. They have been able to maintain a strong track records of making the proper market calls. They are among the investors who are so much aware of when to enter and exit the trade at the right time.

Fresh digital currency funds are usually managed by investment managers who come from equity or foreign exchange markets and, therefore, lack the cryptocurrency experience. These funds appear to purchase the blue chip coins with the highest liquidity. Therefore, the newer crypto coin funds launch, the more the leading coins will be able to benefit.

The Pump and the Dumper

These crypto entrepreneurs will buy a substantial crypto in a relatively unidentified tiny cap coin alongside a group of the enlightened capitalists before being able to start a promotional campaign that is paid for.

The Early Crypto Adopter

These are the kind of people who purchased some leading crypto coins before they became cool. Like this guy but spent it all on pizza. Big mistake!

More on that story here.

Early adopters bought in at a time when none had heard about them. The early crypto adopter can be anonymous, like in the case of the person running the Pineapple Fund. It could also be a blockchain leader who actively discusses their thoughts on the future price of the cryptos in public.

The Whale

A whale, as used in the crypto market, is an investor who has enough money to invest so that their businesses can affect the market price of the asset they are trading. When Bitcoin trades executes trades that exceeds $10,000, they are considered as whales.

A larger percentage of the whales are the people who largely invested in the cryptos in the initial stages. Whales have the power to move the market substantially, which explains why it is smart to look out for them when looking at exchange order books.

The HODLer

The last breed of cryptocurrency entrepreneurs are the HODLer. This is definitely the most known crypto investor and can come in all sizes and shapes. The word “HODL” was drawn from a post that was done by the Bitcoin Talk forum, where a famous BTC investor stated that he would hold on to his BTC investment despite the price drop. He, however, misspelled the term hold by writing “hodl”. Since then “HODL” stands for “Hold On for Dear Life”.

Every crypto investor has their true love coin in which they truly believe in. I personally hodl a big bag of Cardano. I believe that in a few years, I’ll be very happy with my decision. More about Cardano here. I even own this shirt…

A HODLer can either be a small or large investor, a newbie, an early investor, or even an institutional investor. It is basically an investor who truly believes in the future of the digital coins and is ready to hold onto the assets he has invested all through the period of volatility.

Cryptocurrencies act as both the opportunities for investments and new financial tools that are used to increase the importance to business owners and investors. Every digital currency in existence can be classified as any of these cryptocurrencies. These distinctions are of great importance for the crypto investors. They tend to determine what exactly one is investing in, and the kind of person who can invest in the first instance.

Too many times I have seen people get hype about cryptocurrency as they see how the prices went up very fast, and decide to jump in and take the piece of the cake. But the problem is they engage in the wrong time – when the price is at its peak.

As someone who went through education in trading at this type, I appreciate when someone explains well all the types of “players” in the game.

What would you suggest as the best strategy for investment? Do you have any favorite way of investing?

I found a good trend to invest a small amount into new and rising coins (once I did a bit of research for that particular currency), and sell approximately half of the amount once the price goes up so I cover my initial investment. Everything else is pure profit.

Hi! Yeah, there are a couple projects that I am heavily invested in and in for the long haul. I truly believe they have no where to go but up and since most coins are down about 80% from their ATH, the risk to reward ratio is too good to pass up. All I have to do is keep my investment safe and be patient.

As far as day/swing trading, I do something similar to what you do. For the most part, I always take my profits. I keep and eye and an ear out in forums, FB groups, apps like Stocktwitz, etc. to see if I can pick up any valuable info. Then I do my own research, pull up the charts and wait for a good entry point.

For instance, yesterday, I came across a convo regarding Matic Coin. I got in just in time before it mooned. Made 60% on my money in 40 minutes. When it comes to trading, timing is everything. Luck always helps.

What an interesting article. I was looking for some basic information when I discovered your site.

Do you think a novice like me can actually make money in cryptocurrencies?

I don’t have a lot of money to lose and my knowledge is very limited, However, I know more now than I did thanks to your great article.

Hi Marvin, I’m not a financial adviser and I also would not invest anything I’m not willing to lose. Having said that if you look at some of the projects in the top 10 or 20, some are very affordable. And in my opinion, worth the risk. You always want to do your own research before you invest. I’m glad I can help expand your knowledge on the subject and if you have anymore questions, just give me a shout.

I could remember when I registered on bittrex for my first cryptocurrency trading Adventure. I was actually being sensitive and I used to follow crowd. But my huge mistake was when I held like three coins for too long waiting for it to moon again after a drastic fall in price. The coin was steem and two other coins. That was what drove me out of crypto for sometime before I later returned. The burden was too much for me as a beginner. I knew someone who fell under ‘early adopter group’, he once used a reasonable amount of his coin for wine. After the Bitcoin became a lambo,he realised his huge mistake.

Hi Stella, oooh, that’s rough. I owned a little BTC before it went crazy but not enough to retire off of. If history repeats itself, it’s only a matter of time before that happens again. You just need to be positioned well to make it worth while. And it doesn’t need to be bitcoin either. A lot of these Alts cost a few pennies right now when they can easily go over a dollar in the future. Remember: Greed is the poison, Patience is the remedy.